An Opportunity to Seize Back the Digital Plank

Deepak Prabhu, Vice President, Consulting and Design Thinking, writes on how today’s exceptional situation calls for fresh perspectives and creative solutions on the part of the Telecommunications Industry.

THE WIND BENEATH OUR WINGS

In today’s global lockdown scenario, the telecom industry has remained relatively unscathed. Many identify the industry as the invisible hand, helping us stay socially connected but physically distant. Rightly so, and governments around the globe quickly identified it as an essential service and exempted it from the lockdown, which enabled corporates to keep their lights on.

Commenting about the impact of lockdown on people’s life in isolation, LC Singh, Executive Vice Chairman at Nihilent says, “The urge to connect is so fundamental to the construct of being a human and I commend the telecom industry to have provided such invaluable service in these trying times. The data infrastructure it built became a critical cog for the connected world we live in today, ensuring a seamless functioning of the society.”

Interestingly, the telecom sector also became an unexpected ally, assisting governments with outreach and analytics to spread awareness about the pandemic. The work-from-home phenomenon took-off from the shoulder of this important sector, whether it be remote working, virtual private network connectivity, or video and audio conferencing. Our personal lives also piggy-backed along and we have all benefited from the myriad streaming services, whether it be to catch up with friends or extended family, to discover the next interesting recipe to cook, binge watch an interesting series, get a snapshot of news, and developments from around the world, or enjoy a thriller or a family drama for a quiet evening. The telecom sector became the wind beneath our wings.

The business performance numbers that roll in clearly suggest that the industry is heading towards the dawn of a new era. The OTT players in India indicated an average rise in viewership to the tune of 20%, with consumption moving away from mobile devices to other connected devices like the smart television.

The number also indicates a clear switch in network usage to residential networks as opposed to enterprise networks. The sudden surge in data consumption is allegedly threatening many telecom service providers and risk bursting at its seams. The industry association however allays the fear of a choked network and notes that the Telecommunications Companies (Telcos) only used 65-70 percent of the network capacity pre-Covid-19.

TWILIGHT OF VOICE AND THE DAWN OF DATA

We are witnessing a distinct shift with digital going mainstream. While the Telcos’ voice revenue is projected to drop 45% by 2024, increasing data consumption is expected to offset the losses. We stand at a point in time where technologies such as cloud computing, everything as a service, internet of things, social media and big data, artificial intelligence and machine learning, augmented and virtual reality, and many others are starting to get deployed within services we use every day. Couple these with the proliferation of connected devices, smartphones, laptops, televisions, appliances, et al and we have an interesting mix at hand. While some will view these developments as a splendid opportunity, for others it may spell a looming disaster.

The Indian telecom market used to be a vibrant one not so long ago. From the dozen players we had, today there are just a handful, 4 operators to be exact, serving a country with a population of about 1.3 billion, segmented into 22 circles, and all but one, teetering on the edge of bankruptcy. The department of telecom pegs the total adjusted gross revenue (AGR) dues for the industry at Rs 1.47 lakh crores. But as revealed by historical trends, the industry goes through a cycle, periods of turmoil followed by periods of relative calm. And whenever a crisis sounded the death knell, the industry recovered and chugged along contentedly.

From within the current turmoil, first as the result of a price war due to increased competition, and now with Covid-19 killing consumption appetite across the board, one telecom operator however shines bright with a silver lining. Reliance’s Jio.

Interestingly, the company built a cluster of 25+ apps, providing a bouquet of services including recharges, games, music, OTT content, e-commerce, payments, with emphasis on vernacular languages for its consumers. The launch of Reliance Jio’s 4G services is credited by many observes with spurring India’s digital economy. The availability of cheap, reliable ad fast 4G networks drove significant growth in data usage, especially music and video content.

Reliance’s Jio prefers to call itself a digital company, not a telecom major, and we believe, therein lies the secret to its envious market success. While the Reliance group, which also has interests in oil refineries and chemical plants, has its stock battered due to the collapse in oil prices, it could recoup almost all the losses. Other than Mark Zuckerberg- founded Facebook, Silver Lake Partners, Vista Equity Partners, General Atlantic, KKR, Mubadala, Abu Dhabi Investment Authority, TPG, PIF, L Catterton also announced investments in Jio. RIL undertook 12 different transactions with the 10 investors last year. In all, these 12 transactions alone, collectively selling a 24.7% stake in Reliance Jio, is valued at $ 15.27 billion, which also includes two smaller non-telecom related deals.

There is a seat at the table for the competent. LC Singh recalls his conversation a few years ago with a top executive at Pay-TV media powerhouse on changing consumer habits. I was convinced that the future of entertainment was going to be personal, but many were skeptical. As luck would have it, the Pay-TV executive found resonance, he says and we quickly agreed to experiment with the concept of building a community of talent. Today, we are headed on the path to taking entertainment into the social realm for the broadcaster” adds LC Singh.

Nihilent’s tumbhi.com, the underlying social platform engine, has come of age, and LC Singh firmly believes that this will be a compelling proposition for even a committed Telco to resist.

The year 2020 was supposed to be the year 5G, the new super-fast wireless technology, went mainstream. Technology is poised to change the way we live. It is expected to power everything from self-driving cars to augmented reality. The belief is whatever country leads in 5G will lead the world over the coming decades and possibly longer. Its rollout is a mixed bag so far, with North America and Europe lagging behind China. The consensus however indicates that the spurt in demand will come from Asian countries, which account for about 60% of the world’s population. The key suppliers of 5G equipment include Chinese technology giant Huawei, Finland’s Nokia, and Sweden’s Ericsson.

Unfortunately, the shaky relationship between the US and China is going to impact global trade and impact companies like Huawei, which holds the key to affordable 5G technology. Telcos around the world have started to engage and contract with one of these for the technology, soon going to be the pre-requisite to just keeping their customers on their books.

SEIZING BACK THE DIGITAL PLANK

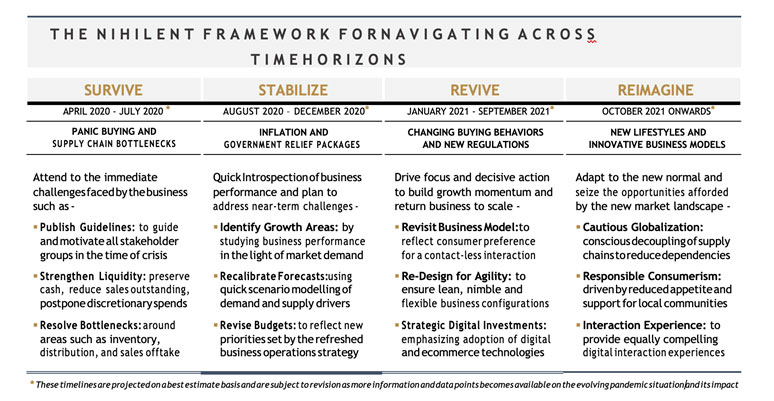

As economies experiment with strategies to restart its engine, we set out a few priorities for the sector across 4 horizons. The first horizon, ‘Survive’ is about managing the turbulence, and seeks to address the immediate challenges that Covid-19 represents to businesses, their customers, workforce, technology, and business partners. The second horizon, ‘Stabilize’, seeks to assess recent business performance and address near-term challenges and the lockdowns economic knock-on effects. The third one, ‘Revive’ seeks to create a detailed plan to return the business to scale quickly as the Covid-19 situation evolves and its impact becomes clearer. The fourth wave, ‘Reimagine’ seeks to accelerate business growth by adapting to the new normal, by studying what a discontinuous shift looks like, seizing the opportunities through innovation.

Talking about the industry and its chronic challenges, Minoo Dastur, CEO at Nihilent feels that the Industry gave away a stellar future to the OTT players on a platter. He observes that the Telcos have largely limited themselves to being an infrastructure business and blames this fate on business lethargy. Minoo points out that Reliance Jio has given a masterclass to the industry incumbents and notes that innovation is the only antidote against the risk of being reduced to a commodity.

While our framework presented above serves as a reasonably good overall guideline, we identify the following priorities for Telcos, as a series of waves to tide over the recessionary market forces.

-

First Wave: The focus here is on survival by attending to the immediate priorities such as supporting government health initiatives in terms of providing a robust communication platform along with accurate contact tracing and tracking information, re-balancing and extending network capacity to support work-from-home businesses, providing self-service digital channels such as chatbots, and providing reasonable credit period to support those who are unable to make payments.

-

Drive responsiveness: Should focus on stabilizing and reviving the business, including but not limited to designing cost containment strategies, re-budgeting for capital expenditures given the revision of revenue targets for the year, assessment and planning for business continuity given the shortages for critical electronic parts and skilled manpower supply, along with focussed strategies to drive revenue assurance initiatives.

-

Second Wave:It is uncertain at this point if credit models and frameworks will change forever but a course correction is imminent in the near-term. Banks will have to take some very tough decisions on their credit decisioning framework keeping in mind the need to protect capital and yet, deploy excess liquidity to generate economic momentum.

-

Third Wave: Focus on specific strategies to reimagine the Telcos to adapt to the new normal. Emphasis should be put on the digital transformation of the Telco’s operations, bolstering the role of digital for customer onboarding and servicing in the form of Omni-channels, chat or voice-enabled bots, and analytics for real-time automated decisioning in favor of customer experience. Telcos will also have to focus on the modernization of their infrastructure and accelerate their migration to 5G, which is expected to be a significant enabler for the digital economy. Last but not least will be re-assessing the business models to lead the way for the connected ecosystems to evolve. For instance, with people spending a large part of their time online, behavioral scientists predict that virtual goods will become much more important than the physical ownership of goods, accelerating the adoption of technologies like virtual and augmented reality.

This will have a wide-ranging impact on industries such as retail, manufacturing, financial services, media broadcasting, healthcare, and even public service delivery. Proactiveness towards responding to the imminent cybersecurity threats and challenges will also differentiate the best Telcos from the mediocre.

This pandemic has demonstrated, perhaps more than any other event in human history, the critical importance that telecom infrastructure plays in keeping businesses, governments, and societies connected and running.

For a future characterized by a digitally connected economy, the telecom sector will be the backbone, which will provide us with the strength to grow and thrive. I would like to sum up quoting LC Singh, where he says, “The comfort with the old must give way for the thrill of the new”. Are any Telcos listening?

Deepak partners with clients from around the world to uncover emerging customer and market dynamics, frame and reframe business challenges, open unchartered spaces and start conversations around the new possibilities. He passionately seeks to leverage design’s transformative capacity to tackle the biggest of the challenges, both business and social.